The Basic Principles Of Transaction Advisory Services

Wiki Article

The Best Strategy To Use For Transaction Advisory Services

Table of ContentsTransaction Advisory Services Can Be Fun For AnyoneTransaction Advisory Services Can Be Fun For AnyoneThe Definitive Guide for Transaction Advisory ServicesThe Transaction Advisory Services IdeasThe Buzz on Transaction Advisory Services

This step ensures business looks its finest to prospective customers. Obtaining business's worth right is critical for a successful sale. Advisors use various methods, like reduced cash money flow (DCF) evaluation, contrasting with comparable firms, and recent transactions, to determine the fair market value. This aids set a fair price and discuss efficiently with future purchasers.Purchase consultants action in to assist by obtaining all the required info arranged, answering concerns from customers, and preparing sees to the organization's area. Transaction consultants utilize their competence to aid service owners manage tough settlements, fulfill buyer assumptions, and structure offers that match the proprietor's goals.

Meeting legal regulations is critical in any company sale. They help service proprietors in preparing for their following steps, whether it's retirement, starting a brand-new venture, or handling their newfound wide range.

Purchase experts bring a riches of experience and understanding, making certain that every facet of the sale is managed professionally. Through strategic preparation, valuation, and negotiation, TAS helps company owner achieve the greatest feasible price. By ensuring lawful and governing conformity and managing due diligence alongside various other bargain staff member, transaction advisors minimize possible dangers and obligations.

How Transaction Advisory Services can Save You Time, Stress, and Money.

By comparison, Large 4 TS teams: Deal with (e.g., when a prospective buyer is performing due diligence, or when a deal is closing and the purchaser needs to incorporate the company and re-value the vendor's Annual report). Are with fees that are not connected to the deal shutting effectively. Gain costs per engagement someplace in the, which is less than what financial investment banks gain also on "tiny offers" (yet the collection likelihood is also much greater).

, however they'll concentrate more on audit and appraisal and much less on subjects like LBO modeling., and "accounting professional only" topics like trial equilibriums and just how to walk through events using debits and credit ratings rather than monetary declaration adjustments.

Transaction Advisory Services - Questions

Professionals in the TS/ FDD groups might likewise interview administration concerning every Get More Information little thing above, and they'll create an in-depth report with their findings at the end of the procedure.The power structure in Purchase Solutions varies a little bit from the ones in investment financial and personal equity careers, and the basic shape resembles this: The entry-level function, where you do a great deal of data and financial evaluation (2 years for a promotion from below). The next degree up; similar job, however you obtain the more interesting little bits (3 years for a promo).

Particularly, it's hard to get advertised past the Manager degree because few individuals leave the job at that phase, and you require to start showing proof of your capacity to generate profits to advancement. Allow's start with the hours and way of living given that those are less complicated to define:. There are occasional late evenings and weekend work, but nothing like the agitated nature of financial investment banking.

There are cost-of-living changes, so expect lower compensation if you remain in a more affordable place outside significant economic why not find out more facilities. For all placements other than Companion, the base pay comprises the mass of the total compensation; the year-end incentive may be a max of 30% of your base pay. Usually, the finest method to raise your profits is to switch over to a various firm and work out for a higher salary and perk

The Buzz on Transaction Advisory Services

At this stage, you should simply stay and make a run for a Partner-level function. If you desire to leave, perhaps relocate to a client and perform their appraisals and due persistance in-house.The major issue is that due to the fact that: You normally need to sign up with one more Large 4 group, such as audit, and job there for a few years and after that move into TS, job there for a few years and after that relocate into IB. And there's still no assurance of winning this IB duty since it depends upon your region, clients, and the employing market at the time.

Longer-term, there is additionally some risk of and due to the fact that examining a firm's historic monetary information is not precisely brain surgery. Yes, human beings will always need to be involved, but with more innovative technology, lower headcounts can possibly sustain client engagements. That claimed, the Purchase Providers team beats audit in regards to pay, job, and exit opportunities.

If you liked this article, you may be curious about reading.

The Single Strategy To Use For Transaction Advisory Services

Create sophisticated monetary frameworks that help in identifying the real market price of a company. Supply consultatory work in connection to business valuation to aid in negotiating and pricing frameworks. Discuss one of the most suitable form of the offer and the sort of factor to consider to utilize (cash, stock, gain out, and others).

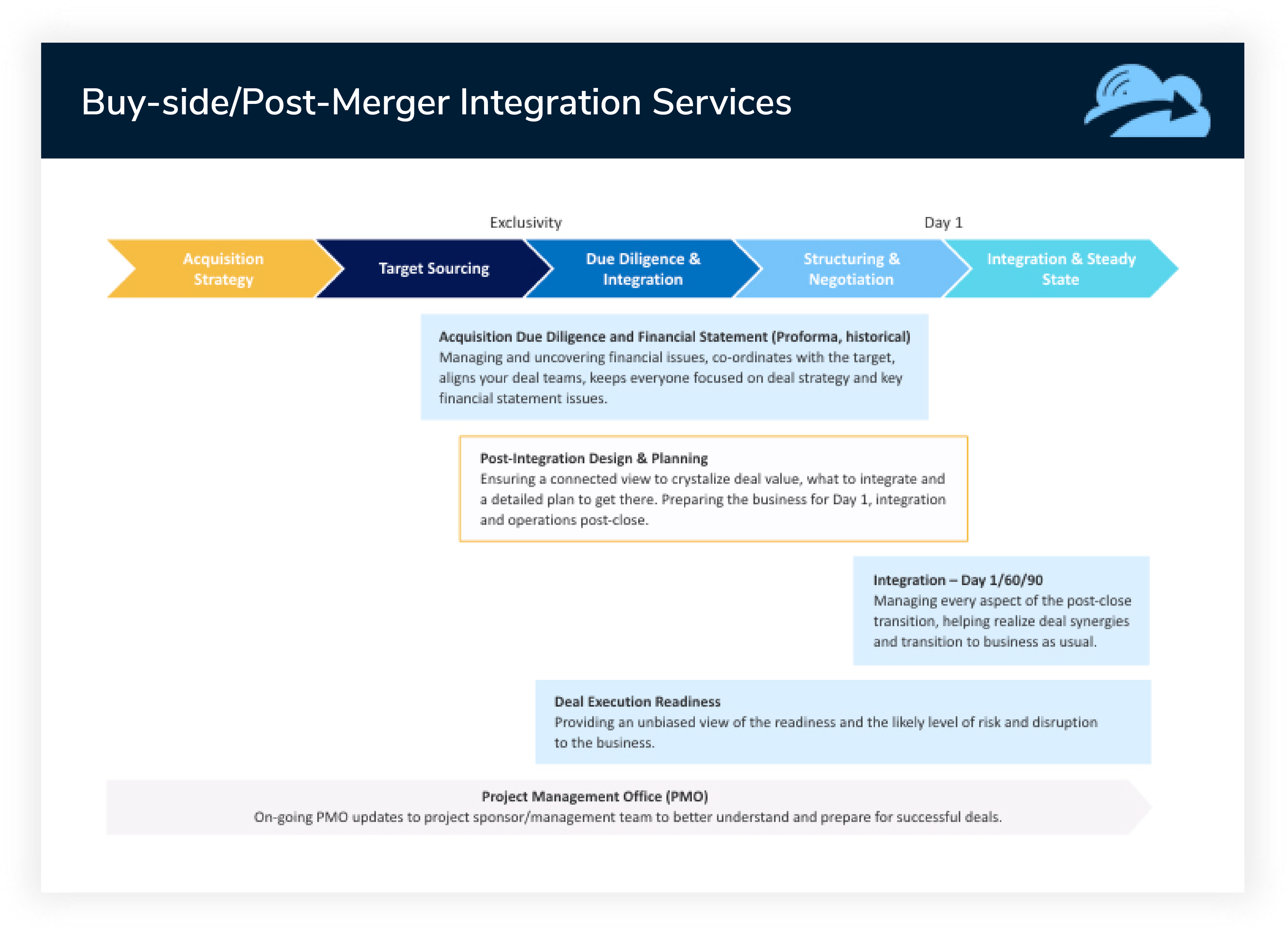

Execute assimilation planning to figure out the process, system, and organizational adjustments that may be called for after the offer. Establish guidelines for incorporating departments, modern technologies, and business processes.

Assess the potential customer base, market verticals, and sales cycle. The operational due diligence provides important insights right into the performance of the company to be acquired worrying threat assessment and worth development.

Report this wiki page